29.10.2025 - Daily Cocoa Market Report

Market Overview

Cocoa futures edged higher on Wednesday, partially recovering from Tuesday’s sharp decline. The move reflected renewed attention to slow West African arrivals and tightening certified stocks after two consecutive sessions of weakness.

Traders also noted mild geopolitical risk linked to post-election unrest in Cameroon, though the broader tone remained cautious amid weak confectionery demand and pressure on consumer sales.

Liquidity continued to migrate from the December to the March 2026 contracts in both New York and London as traders rolled positions ahead of first notice day.

While the share of annual confectionery sales linked to Halloween is negligible in Germany, the holiday remains a key indicator of consumer behaviour in the United States, where it accounts for nearly 20% of annual candy sales. Analysts are watching closely to see whether high cocoa costs have shifted consumer preference toward cheaper non-chocolate treats such as gummies, as reported by Bloomberg and BusinessMirror earlier this week.

Inventory / Stocks

| Region | Oct 29, 2025 | Previous Day | Change | % Change |

|---|---|---|---|---|

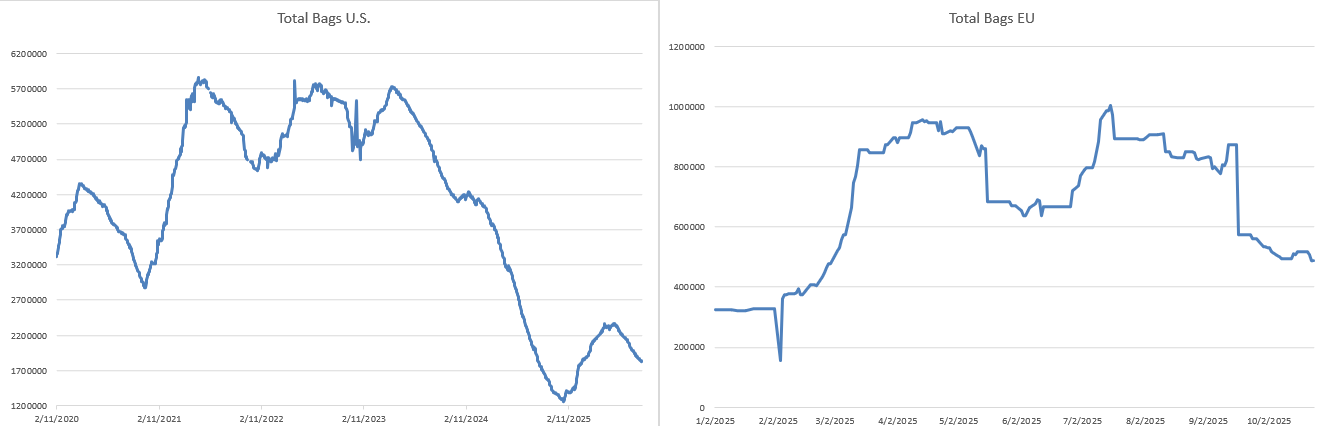

| US Certified Stocks | 1,827,670 bags | 1,836,163 bags | ▼ 8,493 | –0.5 % |

| UK Certified Stocks | 495,156 t | 488,906 t | ▲ 6,250 | +1.3 % |

US exchange stocks fell again, marking the fourth daily decline and reinforcing short-term tightness in deliverable supply. UK certified inventories increased modestly, indicating mild restocking at European warehouses.

Futures / Market Metrics

| Market | Contract | Close | Change | Volume | Structure |

|---|---|---|---|---|---|

| New York (ICE US) | Dec 25 = $6,050/t · Mar 26 = $6,069/t | +$45 (+0.7%) | 24,262 | Contango ($19) | |

| London (ICE UK) | Dec 25 = £4,300/t · Mar 26 = £4,335/t | +£20 (+0.5%) | 17,805 | Contango (£35) |

The rebound in both markets followed Tuesday’s losses (US $6,005; UK £4,280) after Monday’s steeper declines from $6,192 and £4,377 respectively. The modest recovery was mainly technical, reflecting short-covering and light speculative repositioning.

The US–UK arbitrage remained steady near $378/t, showing balanced trans-Atlantic demand.

Ivory Coast and Ghana Supply Situation

Exporters in Côte d’Ivoire reported cumulative arrivals of about 214,000 tonnes by October 26, down 24.9 percent year-on-year but showing a mild improvement from the previous week’s pace. Weather conditions remain seasonally mixed, with alternating rainfall and sunny periods aiding pod filling.

Tropical Research Services (TRS) maintained forecasts of 1.75 million tonnes for Côte d’Ivoire and 500,000 tonnes for Ghana but cautioned that both nations are likely to end the main crop poorly. A favorable mid-crop could offset part of the loss if conditions remain stable through early 2026.

In Ghana, reduced export earnings and persistent cedi weakness are prompting the Cocoa Board to seek a $200/t EUDR-compliance premium to support farmer incomes.

Policy and Industry Developments

Mondelez International trimmed its full-year profit outlook after European chocolate volumes fell 7.5 percentage points and North American volumes 1.8 points. Rising costs and continued price resistance are forcing product reformulations and smaller pack sizes.

Circana’s latest data showed US chocolate candy volumes down 6–8 percent in the 12 weeks to October 5, while non-chocolate confectionery gained 8.3 percent, illustrating a clear shift in consumer preference at high cocoa price levels.

Hershey Co. was scheduled to report earnings later this week, with attention focused on Halloween sales and commentary on cocoa-cost management.

In Cameroon, post-election unrest in Douala left at least 23 dead. While no major disruptions to cocoa exports have been confirmed, the situation continues to inject a mild geopolitical risk premium.

Weather Conditions

Weather patterns across West Africa remain favorable overall. Côte d’Ivoire and Ghana continue to experience a balance of sunshine and light rainfall, aiding pod maturation.

In Cameroon and Nigeria, moderate rainfall persists, though some areas face transport delays.

Forecast models indicate a gradual strengthening of northern trade winds from mid-November, signaling the early onset of the Harmattan, which could dry soils and stress developing pods if it intensifies before late December.

Harmattan Early-Season Outlook

Meteorological forecasts suggest the Harmattan winds could arrive slightly earlier than average this year, beginning in mid to late November. Early episodes are expected to be weak to moderate, primarily affecting northern and central Côte d’Ivoire and Ghana.

If the Harmattan intensifies in December, it may lead to premature drying of the soil surface, particularly in the Soubre, Daloa, and Ashanti regions, where late pods are still maturing.

An early or strong Harmattan phase could stress developing pods and reduce bean size, potentially tightening mid-crop output. However, if conditions remain moderate, the drier spell may actually aid harvesting and post-harvest drying, supporting bean quality.

Traders and analysts are closely monitoring wind speed anomalies and temperature spreads as early warning signals for crop stress during the next 4–6 weeks.

Outlook

Cocoa prices stabilized mid-week as attention turned back to supply fundamentals following early-week selling pressure. With certified stocks trending lower and arrivals still behind seasonal averages, the market maintains a cautiously upward bias.

However, demand weakness remains a limiting factor, with buyers reluctant to chase rallies amid soft retail sales and shrinking chocolate margins. Sustained closes above $6,100 in New York and £4,350 in London would confirm renewed bullish momentum, while a drop below $6,000 could invite renewed liquidation.

Key Watchlist – October 30, 2025

- ICE open interest data for October 29 to identify whether gains were driven by new longs or short-covering

- Hershey Co. quarterly results for Halloween sales and cocoa procurement commentary

- Weekly Ivory Coast port arrivals; a persistent 20–25% deficit would sustain price support

- Cameroon political developments and logistical impact on exports

- Early Harmattan wind indicators across northern Côte d’Ivoire and Ghana

Weekly Summary Box

| Metric | Oct 25 (Friday) | Oct 29 | Change | % Change |

|---|---|---|---|---|

| US Certified Stocks (bags) | 1,858,368 | 1,827,670 | ▼ 30,698 | –1.7 % |

| UK Certified Stocks (t) | 488,906 | 495,156 | ▲ 6,250 | +1.3 % |

| US Futures (Dec 25) | $6,319 | $6,050 | ▼ 269 | –4.3 % |

| UK Futures (Dec 25) | £4,519 | £4,300 | ▼ 219 | –4.8 % |

| US Volume (all contracts) | 18,579 (Oct 24) | 24,262 (Oct 29) | ▲ 5,683 | +30.6 % |

Interpretation:

Cocoa prices regained ground mid-week following steep declines earlier in the week. The rebound was supported by lower US certified stocks, slight improvements in arrivals, and ongoing concerns over weather and political stability in West Africa.

London outperformed slightly on renewed European buying interest. The market remains delicately balanced between tightening supply and subdued demand, with the medium-term tone cautiously bullish heading into November.