28.10.2025 - Daily Cocoa Market Report

Market Overview

Cocoa futures extended losses for a second consecutive session on Tuesday as improved weather and steady port arrivals in West Africa tempered supply concerns.

The December New York contract settled $180 lower (–2.9%) at $6,002, while London cocoa fell £113 (–2.6%) to £4,259.

Both markets traded below their 10-day and 20-day moving averages, indicating a short-term correction after recent gains.

Trading volumes were subdued, with 21,851 lots in New York and 15,668 in London, reflecting limited speculative activity and ongoing position liquidations. The move was largely driven by long funds exiting amid better supply prospects and signs of softer industrial demand.

Inventory / Stocks

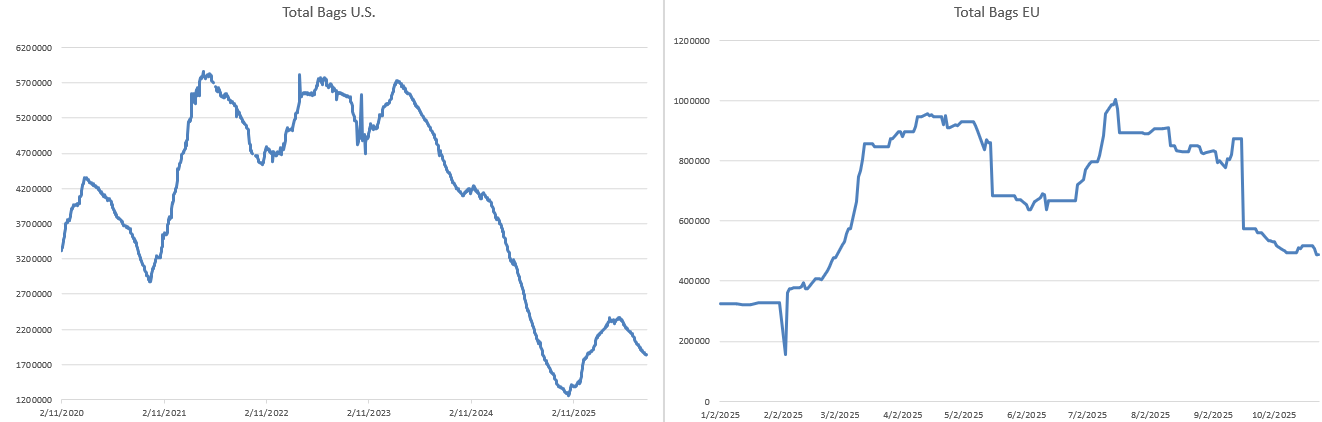

- US certified stocks: 1,836,163 bags (▼ 5,859)

- UK certified stocks: 488,906 tons (unchanged)

U.S. stocks declined slightly, extending the recent drawdown trend and keeping total certified inventories tight.

Combined ICE stocks now stand at around 2.32 million tons, about 8% lower than a year ago, suggesting that physical supply constraints persist even as harvest conditions improve.

Futures / Market Metrics

| Market | Contract | Oct 27 Close | Oct 28 Close | Daily Change | Volume (All Contracts) | Certified Stocks |

|---|---|---|---|---|---|---|

| New York (ICE US) | Dec 25 | $6,182 | $6,002 | –$180 (–2.9%) | 21,851 | 1,836,163 bags |

| London (ICE Europe) | Dec 25 | £4,372 | £4,259 | –£113 (–2.6%) | 15,668 | 488,906 tons |

At an exchange rate of £1 = $1.34, London cocoa equates to $5,702/t, widening the arbitrage discount versus New York to about $300/t.

Market Structure (Contango / Backwardation)

- London: Dec £4,259 → Mar £4,364 (+£105) → contango steepened

- New York: Dec $6,002 → Mar $6,027 (+$25) → mild contango

The widening contango in London indicates reduced nearby tightness as traders anticipate higher deliveries from West Africa in November.

Supply and Fundamental Developments

Ivory Coast

Exporter estimates show cocoa arrivals reached 214,000 tons by October 26, down 24.9% year-on-year, though the pace is improving slightly week-on-week.

Favorable weather continues, with alternating sunshine and rainfall supporting pod development.

The end of election-related disruptions could further boost port deliveries in early November.

Ghana

Ghana faces fresh macroeconomic pressure as cocoa and gold prices weaken, threatening foreign reserves and the cedi’s stability.

The government projects 2025/26 cocoa production near 700,000 tons, up from 531,000 tons last season, but falling prices could offset revenue gains.

Cocoa remains vital to Ghana’s economy, employing over 800,000 farming families, and is now at the center of economic policy as export income weakens.

Cameroon

Protests erupted in Douala and several cocoa-producing areas after opposition leaders rejected President Paul Biya’s re-election, alleging fraud.

At least four people were killed over the weekend, raising concern over potential disruptions to inland cocoa logistics.

Tropical Research Services (TRS) – Output Outlook

Tropical Research Services (TRS - Expana) expects both Côte d’Ivoire and Ghana to have a poor end to the 2024/25 main harvest.

While not yet revising its 2025/26 forecasts — 1.75 million tons for Côte d’Ivoire and 500,000 tons for Ghana — TRS cautioned that downward revisions remain possible if yields deteriorate in the coming weeks.

TRS anticipates a good mid-crop (mitaca) in both countries but warns that persistent climate variability or disease pressure could curtail recovery.

Malaysia & Indonesia

Malaysia secured a tariff exemption for cocoa, palm oil, and rubber exports to the United States, while Indonesia confirmed continued domestic supply deficits, importing roughly 150,000 tons in 2024.

The trade exemptions may increase hedging activity and weigh modestly on nearby ICE cocoa prices.

Industry & Corporate Developments

Mondelez International

Mondelez reported weaker quarterly volumes, with sales down 7.5% in Europe and 1.8% in North America.

Higher cocoa costs and inflation-driven price sensitivity hurt demand, while U.S. consumer confidence weakened amid the government shutdown.

The company now expects FY2025 adjusted EPS to fall ~15%, slightly better than earlier forecasts.

Executives said the firm is focusing on smaller, affordable pack sizes to retain lower-income consumers, a trend signaling soft industrial demand for cocoa-based products.

Hershey

Market participants are closely watching Hershey’s upcoming Q3 report, expected later this week, for further insight into confectionery margins under high input costs.

Weather Conditions

Meteorologists report that seasonal rains are retreating southward across West Africa:

- Ivory Coast: Alternating sunshine and light rainfall – ideal for late pod filling.

- Ghana: Moisture levels remain balanced, aiding flowering.

- Cameroon: Patchy rains continue but may delay transport.

Overall, conditions remain supportive for the 2025/26 main crop, though rainfall-induced road damage and logistical issues persist in parts of western Côte d’Ivoire and Cameroon.

Outlook

Despite the recent two-day correction, cocoa’s underlying fundamentals remain tight.

Improving weather and election stability have reduced risk premiums, but TRS’s warning of a poor end to the main crop adds uncertainty for early 2025 supply.

Industrial demand weakness may limit short-term gains, yet low certified stocks and ongoing logistical fragility continue to provide a medium-term bullish foundation.

Support levels: $5,950 (US) and £4,200 (UK)

Resistance levels: $6,200 / £4,350

Short-term tone: Neutral-to-Slightly Bearish

Medium-term bias: Bullish

Key Watchlist

- Côte d’Ivoire port arrivals (Nov 1 update)

- Ghana cedi stability amid export revenue decline

- Hershey Q3 earnings

- Cameroon political situation and transport flow

- Weather shifts across southern Ghana and western Côte d’Ivoire

Market Interpretation Note

Tuesday’s decline reflected profit-taking and fund liquidation following several days of improved rainfall and supply optimism.

However, Tropical Research Services's (TRS) cautious assessment, weak certified stocks, and persistent logistical vulnerabilities suggest the bearish pressure may be short-lived.

Traders are expected to remain cautious ahead of November’s port delivery data and U.S. consumer spending indicators.

Weekly Summary Box

| Indicator | Current | Previous Friday | Weekly Change | Direction |

|---|---|---|---|---|

| US Certified Stocks | 1,836,163 bags | 1,843,721 bags | ▼ –0.41 % | Lower |

| UK Certified Stocks | 488,906 tons | 489,531 tons | ▼ –0.13 % | Slightly Lower |

| US Futures (Dec 2025) | $6,002 / t | $6,319 / t | ▼ –5.0 % | Lower |

| UK Futures (Dec 2025) | £4,259 / t | £4,519 / t | ▼ –5.8 % | Lower |

| Stock-to-Grinding Ratio (Estimate) | 1.18 × | 1.22 × | ▼ –0.04 pts | Tightening |

| Weekly Volume (US + UK) | 41,300 contracts | 58,285 contracts | ▼ –29 % | Lower activity |