23.10.2025 - Daily Cocoa Market Report

Market Overview

Cocoa futures steadied on Thursday after Wednesday’s sharp rally, with both London and New York markets consolidating near recent highs. Traders assessed the sustainability of the rebound as certified stocks fell further in the U.S. and declined sharply in Europe, underscoring ongoing physical tightness. Election uncertainty in Ivory Coast and Ghana’s plan to seek a $200 premium for EUDR-compliant beans provided additional market focus.

London December cocoa closed at £4,538 per ton, nearly flat from Wednesday’s £4,540, while March settled at £4,593. In New York, December cocoa ended at $6,389 per ton, up modestly from $6,326 the previous day.

Inventory / Stocks

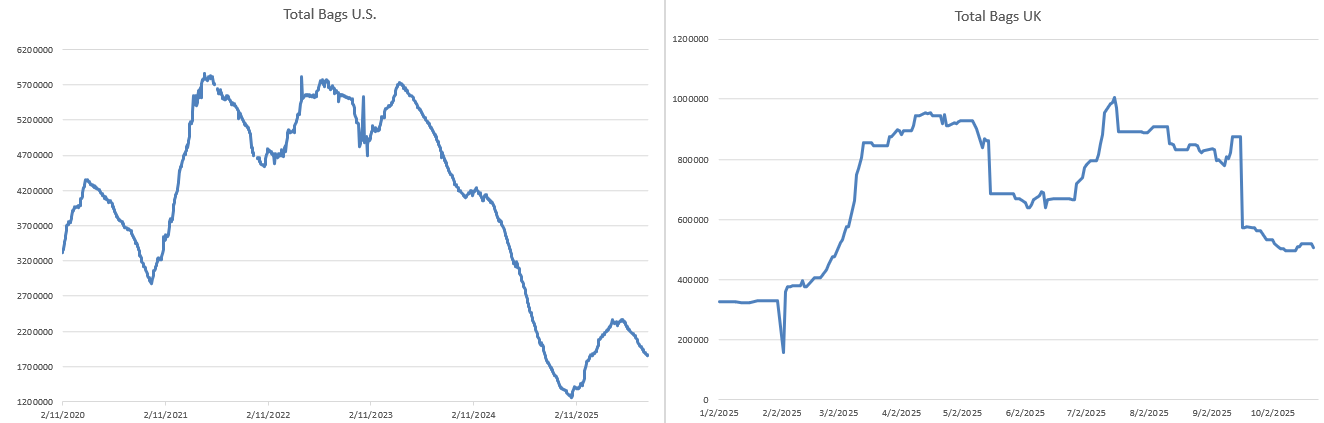

US certified stocks: 1,852,521 bags, down 2,169 from Wednesday’s 1,854,690 (–0.12%).

UK certified stocks: 507,031 tons, down 10,625 from 517,656 (–1.95%).

The drawdown in both exchanges highlights continued bean consumption and limited new certifications. The combined week-on-week stock decline now totals nearly 2.2%, tightening available physical cover for deliveries.

Stock-to-Grind Ratio and Volume Impact

The global stock-to-grind ratio is now estimated around 31.9%, down from roughly 32.4% earlier this week. The ongoing drawdown underscores steady processor activity even as grind data show mild demand softness.

Futures / Market Metrics

| Market | Contract | Oct 23 Close | Oct 17 Close | Weekly Change | % Change | Total Volume (all contracts) | Certified Stocks |

|---|---|---|---|---|---|---|---|

| New York (ICE US) | Dec-25 | $6,389 | $5,917 | +$472 | +8.0% | 25,973 | 1,852,521 bags |

| London (ICE Europe) | Dec-25 | £4,538 | £4,128 | +£410 | +9.9% | 27,931 | 507,031 tons |

Trans-Atlantic price spread:

At an exchange rate of 1 GBP = 1.34 USD, London Dec cocoa equates to $6,078 per ton, compared with $6,389 in New York — a $311 premium for U.S. cocoa (≈ 5.1%), slightly wider than midweek levels.

Total exchange volumes (all contracts) eased from Wednesday’s surge — 25,973 in New York and 27,931 in London — confirming consolidation rather than new speculative momentum. Reduced activity suggests the market is digesting earlier gains while awaiting developments from Ivory Coast’s election and European import regulations.

Market Structure (Contango / Backwardation)

The London cocoa curve remained in mild contango, with March at £4,593 versus December at £4,538 (+£55).

The New York curve also stayed in contango, with March at $6,457 versus December at $6,389 (+$68).

This configuration reflects normal carry costs and expectations of smoother supply in early 2026, rather than the nearby squeeze conditions seen earlier in the month.

Supply and Policy Developments

West Africa

Ivory Coast arrivals remain significantly below last year’s pace — down roughly 30% year-on-year — with many exporters continuing to reject beans due to poor quality, high moisture content, and waste levels. The CCC has reiterated its commitment to maintain high standards despite exporters’ complaints about rejection rates.

In Ghana, officials confirmed plans to introduce a $200-per-ton premium for cocoa beans that meet EU Deforestation Regulation (EUDR) traceability requirements. This move is intended to reward compliant farmers and attract sustainability-oriented buyers, particularly in Europe. The premium could establish a new benchmark for certified-origin pricing and potentially redirect uncertified West African supply toward Asian markets.

Asia (Indonesia)

Indonesia — once the world’s third-largest cocoa producer — announced that domestic demand now exceeds local production, forcing the country to import around 150,000 metric tons in 2024 to meet processing needs. Many farmers have switched to other, more profitable crops such as palm oil or rubber over the past two decades, reducing national cocoa output.

This growing import dependence underscores Asia’s structural shift from exporter to net consumer, adding medium-term support to global demand fundamentals even as West Africa faces quality constraints.

Political Situation – Ivory Coast

With only two days left until the October 25 presidential election, the political atmosphere remains tense. President Alassane Ouattara faces opposition from Simone Gbagbo and business figure Tidjane Thiam, in a vote seen as a referendum on continuity versus reform. Sporadic protests have been reported in Abidjan and Gagnoa, but port operations continue largely unaffected. Exporters remain cautious, limiting inland bean transport until after results are confirmed.

Weather Conditions

Weather in West Africa remained favorable for late main-crop development. Moderate rains and intermittent sunshine in Ivory Coast’s western and central growing zones helped maintain soil moisture while allowing drying to progress smoothly. Ghana’s Ashanti and Brong-Ahafo regions also reported balanced rainfall, supporting pod filling and early harvest activity.

Outlook

Cocoa’s underlying tone remains firm, supported by falling certified stocks and election-related caution in Ivory Coast. However, mild contango and lighter volumes suggest short-term stabilization after the rally.

Resistance is now seen near $6,450 (NY) and £4,600 (LDN), with initial support around $6,250 and £4,500.

Key Watchlist for Tomorrow

- Ivory Coast presidential election logistics and possible disruptions to inland transport

- Ghana’s progress on implementing its $200/ton EUDR premium

- Certified stock updates on ICE US and ICE Europe

- Ongoing EU deforestation regulation deliberations

- Weather patterns in Ivory Coast’s southern belt and Ghana’s Western Region

- Technical resistance: $6,450 NY / £4,600 LDN

Market Interpretation Note

Thursday’s market action represented a pause after a day of short-covering rally. The slight contango across both curves signals reduced immediate stress, yet certified stocks continue to fall, hinting at underlying tightness.

London prices held firm despite lighter volume, reflecting European sensitivity to EUDR adjustments and expectations of traceability premiums. The introduction of Ghana’s $200 EUDR premium reinforces the structural shift toward differentiated cocoa trade, where certified, deforestation-free beans could command sustained premiums.

Overall, sentiment remains cautiously bullish, with traders eyeing election outcomes and certified stock trends as the next major catalysts.