22.10.2025 - Daily Cocoa Market Report

Market Overview

Cocoa futures posted their strongest rally in more than two months on Wednesday, rebounding sharply from recent lows as short covering intensified across both exchanges. The surge was triggered by the European Union’s decision to shorten its deforestation-law enforcement delay to six months instead of one year, combined with continuing concerns about poor-quality bean arrivals from Ivory Coast.

London December cocoa rose 7.6%, closing at £4,540 per ton, up from £4,219 on Tuesday. New York December cocoa jumped 6.4% to $6,326 per ton, from $5,944 the previous session. The move reflected heavy speculative position adjustments as funds began covering shorts, suggesting that prices may be establishing a technical floor after weeks of bearish pressure.

Inventory / Stocks

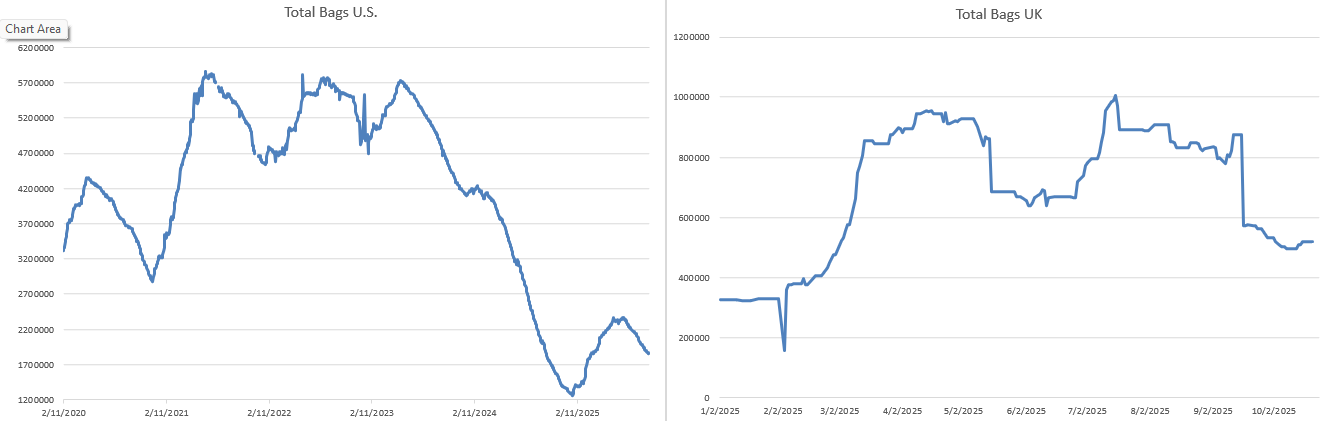

US certified stocks: 1,854,690 bags, down 3,678 from Tuesday’s 1,858,368 (–0.20%).

UK certified stocks: 33,130 tons, unchanged from the previous session.

The modest drawdown in U.S. stocks reflects steady loadouts and reduced new grading. European stocks remain stable but lean, as port arrivals from Ivory Coast stay well below last year’s levels. The global stock-to-grind ratio is estimated near 32.4%, indicating gradually tightening inventories relative to processing volumes — a near-term supportive factor for prices.

Futures / Market Metrics

| Market | Contract | Tuesday Close | Wednesday Close | Daily Change | Volume (lots) | Open Interest | Certified Stocks |

|---|---|---|---|---|---|---|---|

| New York (ICE US) | Dec 2025 | $5,944 | $6,326 | +6.4% | 34,986 | 122,332 | 1,854,690 bags |

| London (ICE Europe) | Dec 2025 | £4,219 | £4,540 | +7.6% | 41,960 | 164,930 | 33,130 tons |

Price Spread (USD equivalent):

Using an exchange rate of 1 GBP = 1.337 USD, London cocoa equates to roughly $6,068 per ton, versus $6,326 in New York — a spread of $258 (US premium ≈ 4.1%), slightly narrower than the day before.

Volume and Open Interest Analysis:

Trading activity surged across both exchanges. London turnover climbed to 41,960 lots, its highest since August, while New York reached 34,986 lots. Open interest in London rose modestly, whereas it was steady in New York, consistent with heavy short covering rather than broad new buying. The intensity of trading signals large-scale speculative repositioning after weeks of decline.

Market Structure (Contango / Backwardation):

In London (ICE Europe), the market showed a mild contango, with the March 2026 contract (£4,549) trading £9 above December 2025 (£4,540). This structure suggests that while nearby demand remains firm, traders still anticipate slightly better availability and lower logistical risk early next year. It also indicates that the extreme tightness seen earlier in October has eased somewhat after last week’s surge.

In New York (ICE US), the curve also remained in contango, with March 2026 cocoa at $6,396, up $70 from December’s $6,326. This modest premium reflects normal storage costs and balanced nearby supply, consistent with steady U.S. certified stocks.

Overall, both markets are now in light contango, a neutral-to-soft configuration suggesting that while short-term tightness persists, traders expect smoother supply and lower risk premiums into early 2026.

Supply Developments

Ivory Coast port arrivals by October 19 totaled 132,000 tons, down 31.6% year-on-year. Exporters continue to reject significant volumes of beans — up to 60% in certain areas — due to mold, small size, and foreign-matter contamination. Financing challenges and high farmgate prices further constrain fresh deliveries for export.

In Ghana, Agriculture Minister Eric Opoku said 2025/26 production should surpass the initial 650,000-ton projection, thanks to favorable weather and ongoing rehabilitation of diseased farms. Though this suggests recovery, export growth may remain limited until Cocobod strengthens its financing pipeline.

Weather Conditions

Ivory Coast enjoyed mostly light, well-distributed rains with sunny breaks — ideal for drying beans and supporting pod filling. Farmers in Daloa and Soubre reported that soil moisture levels remain sufficient for a strong December–January harvest. Ghana and Nigeria experienced scattered showers without disrupting fieldwork, keeping crop quality stable.

Policy and Industry Developments

The European Union’s decision to reduce its deforestation-law enforcement delay from one year to six months had a powerful market impact. The move reassured environmental advocates but forced traders to accelerate compliance planning. European importers began securing traceable supplies earlier than expected, lifting the London market more than New York due to proximity to EU consumption.

CRA (Commodity Risk Analysis Ltd.) reaffirmed its forecast of a 404,000-ton global surplus in 2025/26 and warned that new plantings could yield a larger 2026/27 surplus, potentially re-pressuring prices next year. Meanwhile, Ecuador’s cocoa exports rose 15% year-on-year in September to record highs, with 2025/26 production projected between 560,000 and 650,000 tons — emphasizing Latin America’s expanding role in global supply.

Ivory Coast Political Update

With elections scheduled for October 25, tensions remain high. President Alassane Ouattara faces growing opposition and public protests against his fourth-term bid. Authorities sentenced 26 demonstrators to prison earlier this week. Security forces continue to guard major transport corridors from Abidjan to San Pedro. Exporters report precautionary slowdowns in bean transport to mitigate potential disruptions.

Outlook

The strong rebound on Wednesday suggests that cocoa prices may have found a near-term bottom. Technical momentum favors continued short-covering, especially if arrivals remain slow in West Africa and certified stocks continue to draw down.

Resistance is now seen near $6,400 in New York and £4,600 in London, with initial support at $6,100 and £4,400.

Key Watchlist for Tomorrow

- Ivory Coast election risk and export logistics

- Ghana’s updated crop outlook and Cocobod financing

- EU deforestation regulation amendments and importer reactions

- Certified stock flows and grading results in ICE US

- West African weather trends

- Technical resistance at $6,400 (NY) and £4,600 (LDN)

- Speculative positioning and spread movement between markets

Market Interpretation Note

Wednesday’s surge was largely short-covering-driven, as funds trimmed record short exposure amid signs of supply tightening and regulatory momentum in Europe. Volume expansion alongside stable open interest confirms that the rally was fueled by position closing rather than fresh speculative longs.

London outperformed New York due to stronger regional sensitivity to the EUDR and traceability requirements. The modest U.S. stock drawdown and firm processing demand point to an improving physical balance, while heavy short liquidation may continue to drive volatility in the days ahead.

Overall sentiment has shifted from bearish to cautiously bullish, with technical and fundamental forces aligning toward a potential short-term consolidation above $6,200 (New York) and £4,500 (London).