21.10.2025 - Daily Cocoa Market Report

Market Overview

Cocoa futures strengthened on Tuesday, supported by a rebound in London prices and steady trading in New York. The European Commission’s confirmation of a shortened enforcement delay for the EU Deforestation Regulation (EUDR) added mild speculative buying in London, while traders continued to assess improving weather conditions in West Africa and declining arrivals in Ivory Coast.

London December cocoa rose 2.5% to close at £4,219 per ton, up from £4,118 on Monday, while New York December cocoa gained slightly to $5,944 from $5,940. Trading volumes were moderate, with 24,650 lots in London and 16,953 in New York.

The trans-Atlantic price spread narrowed to approximately $303, with New York maintaining a modest premium. This adjustment reflected relative market normalization after Monday’s European-led rally and currency differentials linked to GBP/USD strength.

Inventory / Stocks

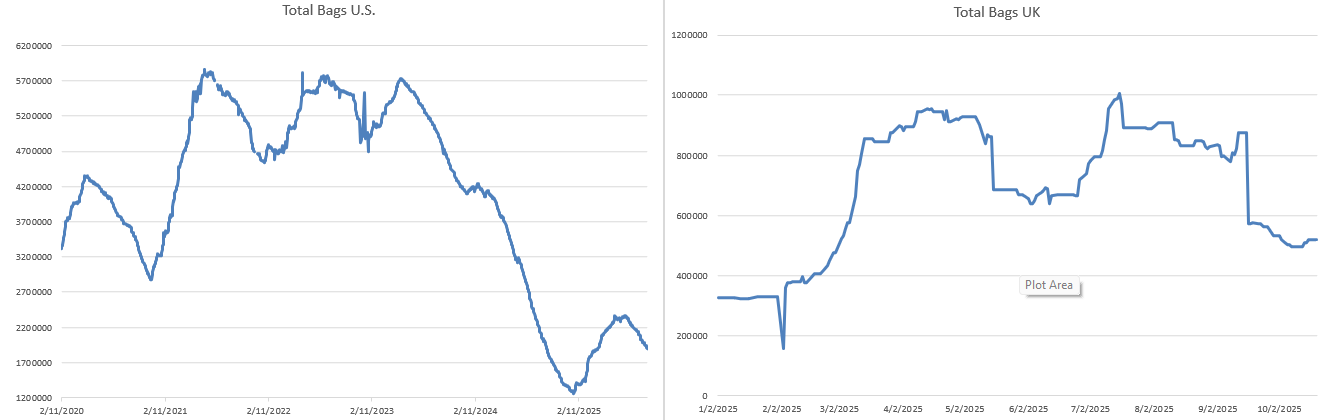

US certified stocks: 1,858,368 bags

Down by 11,636 from Monday’s 1,870,004 (–0.6%).

The decline indicates steady offtake by U.S. processors and limited fresh warehouse inflows, consistent with reduced port arrivals from West Africa.

UK certified stocks: 517,656 tons

Unchanged from the previous day, reflecting stable warehouse conditions and balanced short-term physical demand in Europe.

Based on current Q3 grind data, the global stock-to-grind ratio stands near 32.5%, slightly below the five-year average of around 34%. The decline in U.S. certified stocks suggests that inventories are tightening marginally faster than processing rates, providing underlying price support despite soft demand signals. The ratio remains well above the critically tight conditions of early 2024 but shows a gradual normalization following two years of deficit-driven drawdowns.

Futures / Market Metrics

| Contract | Close | Daily Change | Volume | Certified Stocks | Spread vs. Other Market |

|---|---|---|---|---|---|

| US (Dec 2025) | $5,944 | +0.1% | 16,953 | 1,858,368 bags | — |

| UK (Dec 2025) | £4,219 | +2.5% | 24,650 | 517,656 tons | –$303 (approx.) |

Volume Analysis:

Trading volume remained moderate, continuing the subdued pattern seen since the post-grind data selloff. The limited turnover indicates hesitation among speculative funds. Instead, trade-related buying linked to EUDR news and election hedging in Ivory Coast accounted for most of the session’s upward movement.

Sustained low volume during price rebounds typically implies a technical rather than structural rally, suggesting that broader momentum remains neutral until either weather or political shocks drive renewed fund activity.

European Regulatory Developments

The European Commission confirmed that companies will be granted only a six-month grace period to comply with the EU Deforestation Regulation instead of the one-year delay proposed earlier. The decision maintains the law’s timeline for implementation at the end of 2025, ensuring full compliance by mid-2026.

The regulation, covering cocoa, coffee, soy, palm oil, and other key commodities, is designed to restrict imports tied to deforestation. The shortened transition period was seen as a signal of the EU’s commitment to sustainability goals, despite earlier industry requests for more time. While the change initially boosted London cocoa futures, Tuesday’s session saw more measured reactions as traders reassessed the near-term impact.

Ivory Coast and Ghana Supply Situation

Cocoa arrivals at Ivorian ports reached 132,000 tons by October 19, down 31.6% from the same period last season. The slowdown continues to reflect exporter financing issues, higher farmgate prices, and ongoing bean quality problems. Exporters report rejection rates as high as 60% due to mold and waste material, forcing traders to seek alternative origins or delay shipments.

In Ghana, fiscal stress persists amid a GH₵21.5 billion spending shortfall and constrained Cocobod funding. With weaker cocoa revenue and an artificially supported cedi, Ghana’s ability to sustain timely purchases and exports remains under scrutiny ahead of the 2026 budget cycle.

Weather Conditions

Weather in Ivory Coast remained favorable for bean development. Farmers reported light rainfall combined with extended sunny intervals, particularly in Daloa, Soubre, and Yamoussoukro. Conditions are improving pod quality and supporting main-crop formation through January. The current pattern of alternating sun and showers is ideal for maintaining soil moisture while preventing excess mold.

In Ghana, similar patterns were reported, with scattered rainfall aiding maturing pods in the Ashanti and Western regions. No harvesting delays were noted, and overall weather remains supportive of a strong late main crop.

Policy and Industry Developments

CRA projected a global cocoa surplus of 404,000 tons for the 2025/26 season and warned of a potential larger surplus in 2026/27 as new plantings mature, suggesting the risk of structurally lower prices in the medium term. In contrast, Ecuador’s output continues to expand. StoneX reported exports up 15% year-on-year in September, reaching record highs, with crop projections ranging between 560,000 and 650,000 tons for 2025/26.

The European Commission’s EUDR enforcement stance also added support to London prices, as traders expect tighter documentation and compliance costs for importers, potentially reducing short-term trade efficiency.

Political and Election Update – Ivory Coast

With the presidential election scheduled for October 25, tensions remain elevated in Ivory Coast. Former first-lady Simone Gbagbo has emerged as the key opposition figure against incumbent President Alassane Ouattara, who is pursuing a controversial fourth term. Security forces have intensified actions against protest organizers, with 26 opposition members sentenced last week for unlawful demonstrations.

Although the unrest has not yet affected cocoa transport or port logistics, local traders remain cautious. Exporters have slowed inland deliveries from Daloa and Gagnoa due to fears of road blockages in the event of escalating protests. The election outcome will be critical in determining near-term export flows and investor sentiment in the cocoa sector.

Outlook

Cocoa’s short-term direction remains shaped by West African supply constraints and political risk rather than demand fundamentals. European price leadership may persist if EUDR-related positioning continues. However, with speculative positions in ICE Europe still moderately net short, a period of short covering is possible should weather or political headlines tighten the supply outlook further.

In contrast, CRA’s forecast of a large surplus into 2026/27 tempers long-term bullish expectations, especially as Ecuador’s expanding production continues to fill market gaps.

Key Watchlist for Tomorrow

- Ivory Coast election developments and potential transport disruptions near Abidjan and San Pedro

- Ghana Cocobod liquidity situation and forward sales reports

- EU parliamentary debate on the deforestation regulation enforcement timeline

- Technical levels: New York Dec support $5,900, resistance $6,050; London Dec support £4,150, resistance £4,300

- Managed money positioning and spread activity between London and New York contracts

Market Interpretation Note

The cocoa market remains delicately balanced between tightening near-term supply and emerging long-term surplus projections. Price behavior on Tuesday reflected a transition phase: European traders re-entered long positions following the EUDR enforcement update, while U.S. traders maintained a wait-and-see stance amid limited volume and the absence of updated CFTC data.

Open interest analysis suggests that speculative funds in London maintain a moderately net short position, estimated near 17,000 lots. This positioning—combined with subdued intraday volumes—indicates that the recent rally was driven more by short covering and discretionary buying from commercial hedgers than by fresh speculative demand. The UK market’s outperformance relative to New York aligns with this pattern, as EUDR-sensitive European participants rebalanced exposure toward certified traceable origins.

The stock-to-grind ratio, currently hovering around 32.5%, implies inventories remain tight enough to prevent steep declines but not yet low enough to trigger panic buying. This equilibrium continues to support a neutral-to-bullish bias, particularly if weather or political volatility in Ivory Coast intensifies.

In the short term, London remains technically supported near £4,150, with upside momentum capped by £4,300 unless fresh fund participation emerges. New York cocoa shows comparable stability between $5,900 and $6,050, with a potential upside breakout contingent on post-election supply clarity in Ivory Coast.

Given the compressed spread between London and New York and the relatively light trading volumes, there is scope for a short-covering rally if sentiment improves or if exporters confirm persistent quality issues in West African deliveries. However, any sustained upward move will likely meet resistance from broader macroeconomic headwinds and the outlook for a global surplus in 2025/26.